Traders Blame ‘Insane’ Tech Advancements for Quiet FX Markets

(Bloomberg) — Advancements in electronic trading may be crushing volatility in the currency market, making prolonged wild swings a thing of the past.

That’s the view of some of the participants at an annual industry shindig in Barcelona this week, where the impact of growing automation and algorithmic trading were the hot topics. Some warned that the lack of dramatic action creates the risk that market makers may exit as it becomes harder to generate profits.

Most Read from Bloomberg

The comments come as volatility in the $7.5 trillion-a-day foreign-exchange market has dwindled to near the lowest in a year, making the turbulence around April’s US trade tariff news a blip in a longer-term decline. While traders thrive on big swings, a calmer environment could be good for asset managers and companies looking to hedge their exposure.

“The ability for volatility to collapse has gone up exponentially,” said Gordon Noonan, head of FX trading at Schroders, pointing to price action after US non-farm payrolls data as evidence of “insane” developments in electronic trading. “Spreads used to blow out for ages, now we’re back straight within 30 seconds.”

The shift has turned currencies into a strange corner of global markets, detached from the bigger swings seen in stocks and bonds despite a plethora of economic and geopolitical risks.

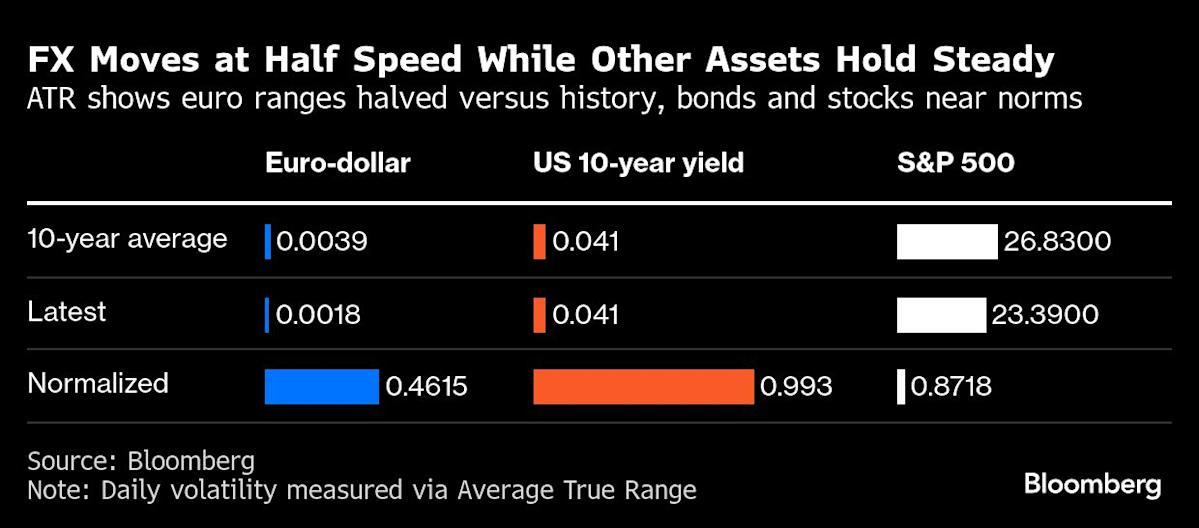

The calm shows up across multiple measures. The euro’s intraday moves are less than half the long-run norm, even as Treasury yields are swinging almost exactly in line with their historical rhythm. Bloomberg’s Market Impact Monitor also shows a tighter FX response recently to major economic releases compared to Treasuries.

There are still some sporadic intraday price spikes — like the big moves seen during April’s tariff turmoil and around central bank meetings — but the market now more quickly returns to a sleepier status quo due to the changing makeup of the dominant players, according to XTX Markets Ltd.

“A lot of that is down to the rise of pod shops and so many competing systematic strategies,” said Jeremy Smart, head of distribution at the firm. “It is possible to see a world where non banks look at FX and go: ‘the returns just aren’t really that valuable versus other asset classes’.”

That’s turned betting against volatility into a key strategy in currency markets. In the past, asset managers would use such an environment as a chance to snap up cheap hedges against the next flare-up, but such events are becoming rarer.

Leave a Comment

Your email address will not be published. Required fields are marked *